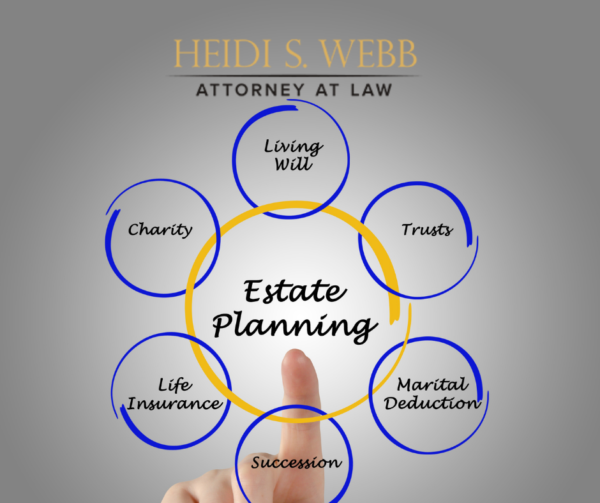

Navigating the Future: Essential Estate Planning Tips

In the realm of financial planning, estate planning stands out as a crucial component that often requires careful consideration and strategic decisions. Here are some key estate planning tips to help you navigate this intricate process and secure a stable future for your loved ones.

Understanding the Basics of Estate Planning

Embarking on the journey of estate planning necessitates a fundamental understanding of the process. Begin by taking stock of your assets, debts, and financial goals. This foundational step lays the groundwork for crafting a comprehensive estate plan.

Drafting a Clear and Detailed Will

A will serves as the cornerstone of any estate plan. Clearly outline your wishes regarding the distribution of assets, appointment of guardians for minors, and any specific bequests. Regularly review and update your will to reflect changes in your life circumstances.

Consideration of Trusts for Asset Protection

Explore the option of establishing trusts to provide a higher level of control over the distribution of your assets. Trusts can also offer enhanced privacy, minimize estate taxes, and facilitate a smoother transition of wealth to beneficiaries.

Nomination of Beneficiaries and Assigning Power of Attorney

Specify beneficiaries for your various accounts, such as life insurance policies and retirement accounts. Additionally, appoint a power of attorney to make financial and healthcare decisions on your behalf in case of incapacitation.

Mitigating Estate Taxes with Strategic Planning

Estate taxes can significantly impact the assets passed on to your heirs. Work with financial and legal professionals to develop strategies that minimize tax liabilities, potentially preserving more of your wealth for your beneficiaries.

Regular Review and Update of Estate Plan

Life is dynamic, and so should be your estate plan. Regularly review and update your plan to accommodate changes in personal relationships, financial status, and applicable laws. This proactive approach ensures that your estate plan remains aligned with your intentions.

Open Communication with Family Members

Effective estate planning involves more than legal documentation; it requires open communication with your family. Clearly articulate your decisions, discuss your intentions with heirs, and address any concerns they may have. This transparency can prevent misunderstandings and foster family harmony.

Seeking Professional Guidance

Estate planning is a complex field with legal and financial intricacies. Engage the services of experienced professionals, such as estate planning attorneys and financial advisors, to ensure that your plan is legally sound and optimized for your unique situation.

Utilizing Life Insurance for Additional Protection

Life insurance can be a valuable tool in estate planning. It provides a financial cushion for your loved ones and can help cover debts, funeral expenses, and estate taxes. Evaluate your life insurance needs and consider incorporating it into your overall plan.

Estate Planning Tips: A Holistic Approach to the Future

In the tapestry of financial planning, estate planning threads the needle to create a secure future for you and your loved ones. By implementing these estate planning tips, you can navigate the complexities of this process with confidence.

For more in-depth insights into Estate Planning Tips, visit Estate Planning Tips. Secure your legacy today.