Ensuring Compliance Best Practices in Law Firm Accounting

Introduction:

In the fast-paced and often intricate world of law firm operations, ensuring compliance with accounting standards is not just a box to check—it’s a fundamental pillar supporting the integrity and sustainability of the practice. From managing client funds to navigating tax obligations, law firms must adhere to stringent regulations while maintaining efficient financial workflows. In this article, we delve into the best practices that underpin effective compliance in law firm accounting, offering insights and strategies to navigate this complex landscape.

Understanding Regulatory Frameworks:

At the heart of law firm accounting compliance lies a deep understanding of regulatory frameworks. Law

Guiding Legal Responsibilities: Expert Advice for Clarity

Guiding Legal Responsibilities: Expert Advice for Clarity

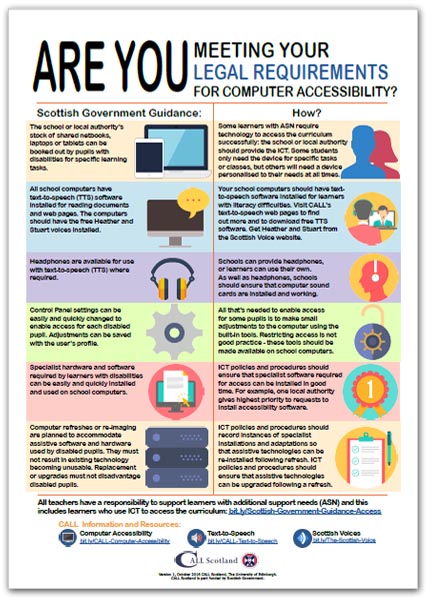

Understanding and fulfilling legal responsibilities is paramount for individuals and businesses alike. Explore expert guidance to ensure clarity and compliance in navigating the complex landscape of legal obligations.

Identifying Personal Legal Responsibilities

Personal legal responsibilities encompass a range of obligations, from adhering to traffic laws to fulfilling contractual agreements. Understand the specific legal duties applicable to your personal circumstances. This includes obligations related to property ownership, family law matters, and individual rights and responsibilities in various contexts.

Navigating Business Legal Responsibilities

For businesses, legal responsibilities extend across multiple dimensions. Compliance with employment laws,